Revolut India App

Introduction

Revolut, is a global fintech giant, as a part of the expansion strategy they want to launch in India. As a Senior Product Designer in the Expansion department, my primary responsibility was to lead the creation of the Revolut India App

Problem Statement

-

Divergence in Regulatory Frameworks: Adapting to the Indian regulatory landscape, which significantly differed from global standards, required meticulous planning and execution.

-

Feature Limitations: Due to regulatory constraints, certain features that were integral to the global version of the app couldn't be immediately implemented. This prompted the need to prioritize and create a focused, regulatory-compliant version for the Indian market.

Solution

The redesign process was approached comprehensively, with a keen focus on compliance and user experience. The following key solutions were implemented:

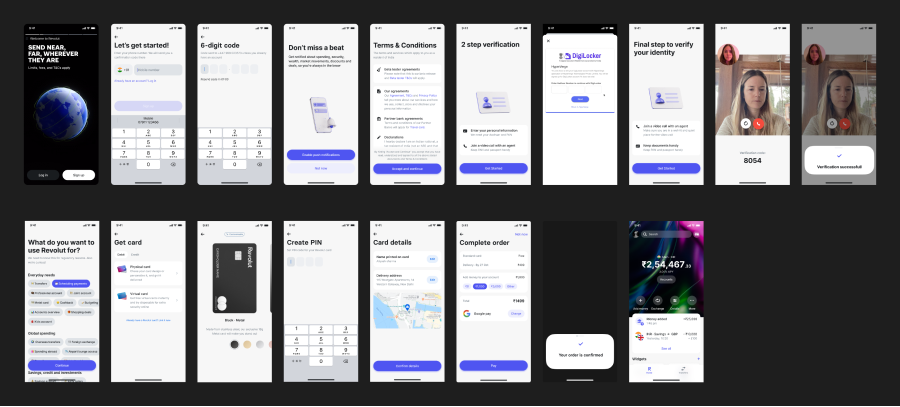

- Onboarding Flow Redesign: The onboarding flow was completely redesigned to align with Indian regulatory requirements for KYC details collection. This not only ensured compliance but also provided a seamless experience for users navigating through the initial setup of their accounts.

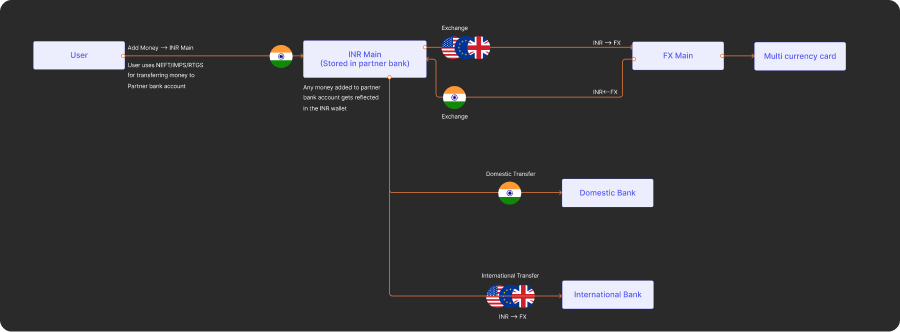

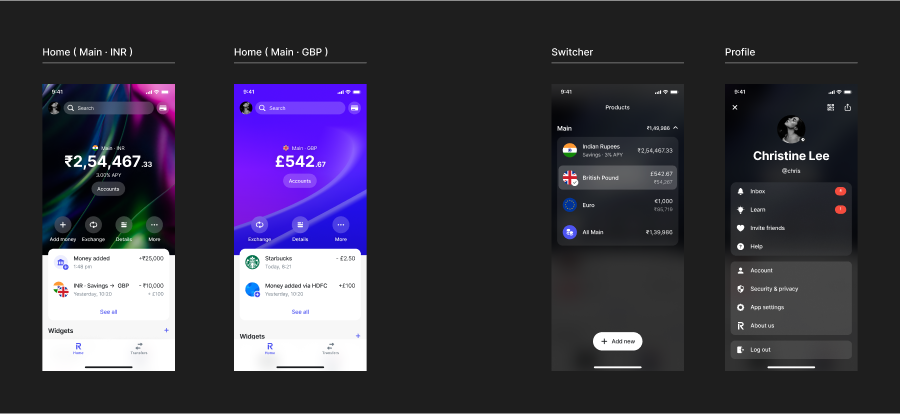

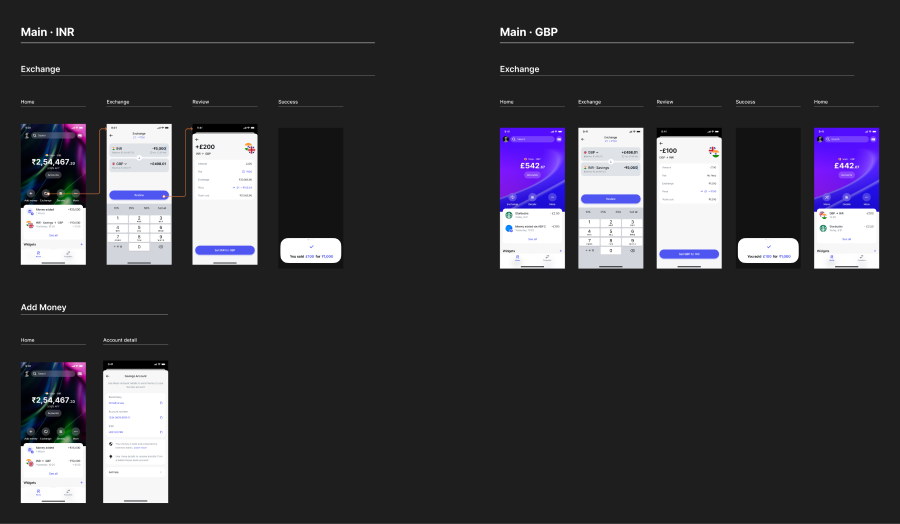

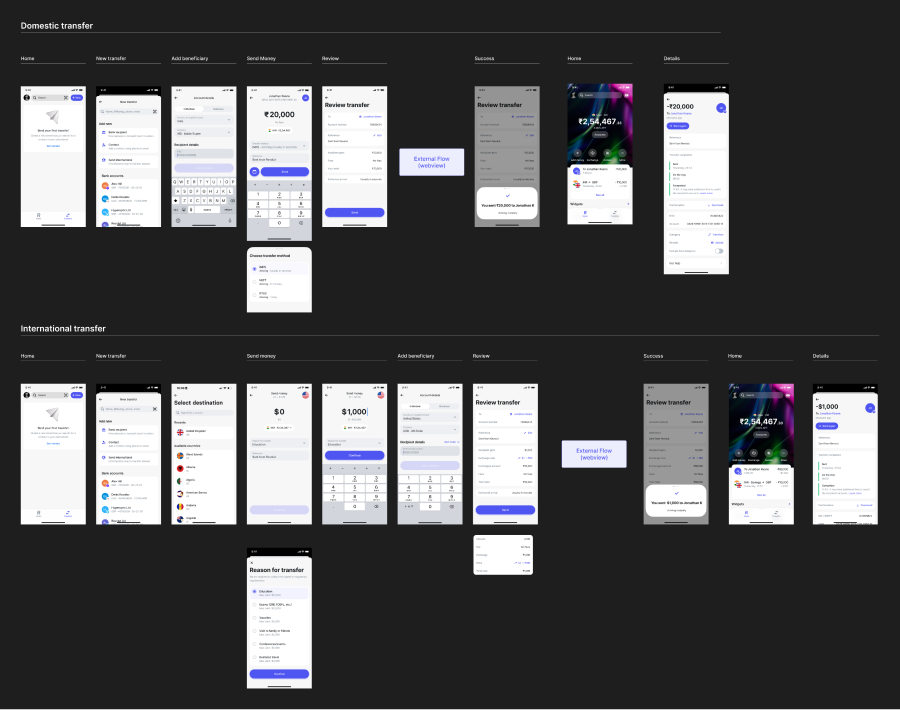

- Core Flow Redesign: All core flows such as, Adding money, Currency exchange, domestic and international transfers had to be redesigned to work with the Indian banking systems and ensure compliance with the regulatory frameworks.

Outcome

The redesigned Revolut India App is under review by the regulators for External tetsing and Validation which is a major milestone towards launching Revolut in India.