Wealth Protection

Context

As a Senior product designer at Revolut I was tasked with creating a new feature to provide an additional layer of protection for users' assets, particularly in scenarios where the user's phone or credentials may be compromised. The aim is to provide the users with the right tools to protect themselves from Financial crimes.

Problem

As the digital landscape evolves, so do the threats to financial security. Account takeovers, where unauthorized individuals gain access to a user's financial accounts, pose a significant risk. In the event of a stolen phone or compromised login credentials, users are vulnerable to unauthorized transactions that can jeopardize their savings and investments.

Traditional security measures, such as passwords and PINs, may not provide sufficient protection in scenarios where the user's device or login information is compromised. Revolut recognizes the need for an advanced security solution that add another layer of security to safeguard users' financial assets.

Solution

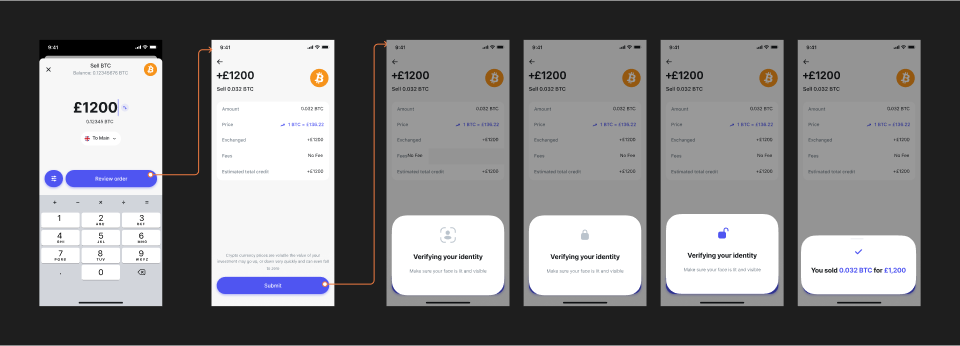

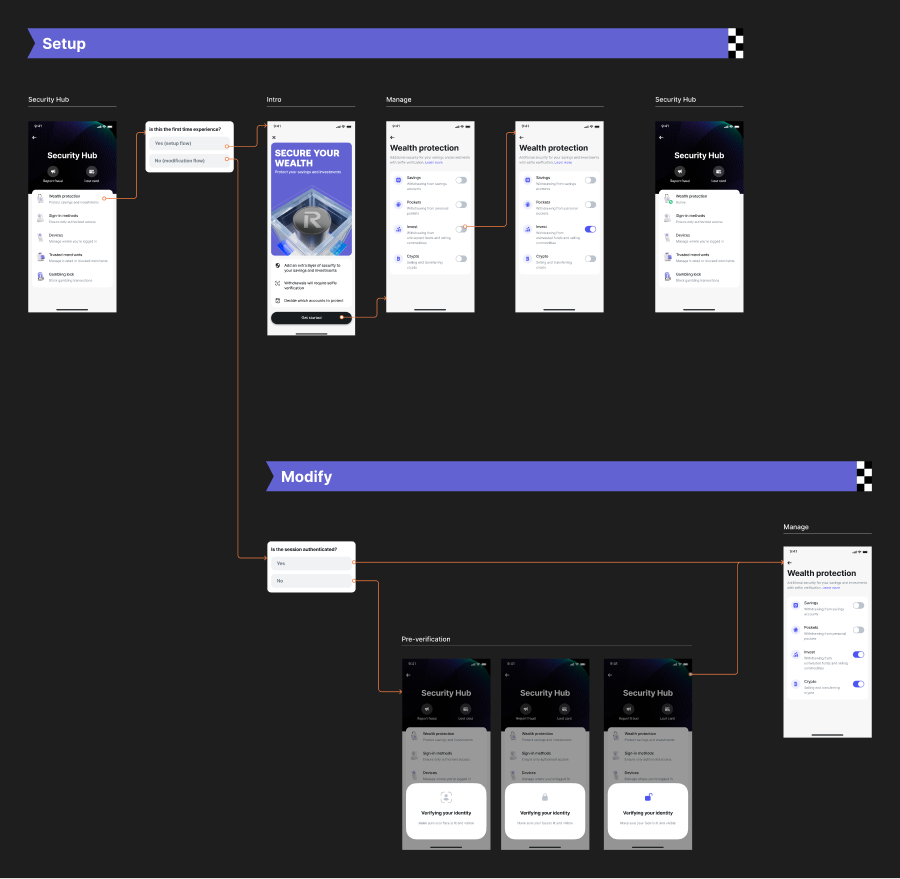

Revolut's innovative solution involves the implementation of proprietary facial verification with liveness checks for specific types of transactions. Users have the flexibility to choose which transactions they want to protect with this additional layer of security.

When a user initiates a protected transaction, the system prompts them to undergo facial verification. This facial verification process adds a dynamic element to the authentication process, significantly reducing the risk of unauthorized transactions even if the user's phone or credentials are stolen. By tying the verification to the user's unique facial features and liveness, Revolut ensures that only authorized individuals can complete protected transactions, providing a robust defense against account takeovers.